Get out of debt as quick as possible

Before COVID-19, the personal debt figures were staggering, so are they now escalating exponentially? That is what most people think, but the opposite is true. What traditionally has been horrible has now improved slightly. According to the CMHC (Canada mortgage and housing corporation), the personal debt-to-income ratio in Canada has gone from 175% to 158%. Mortgage debt has gone from 115% to 105%.

But that still means for every $1 earning, we are still spending $1.58. Anyone can see that this is a recipe for disaster, as a day of reckoning will one day appear.

Our American neighbours have a debt-to-income ratio of 90%, meaning they spend only 90₵ for every $1 they earn. At one time, they were much higher than us.

So, what are we spending our money on?

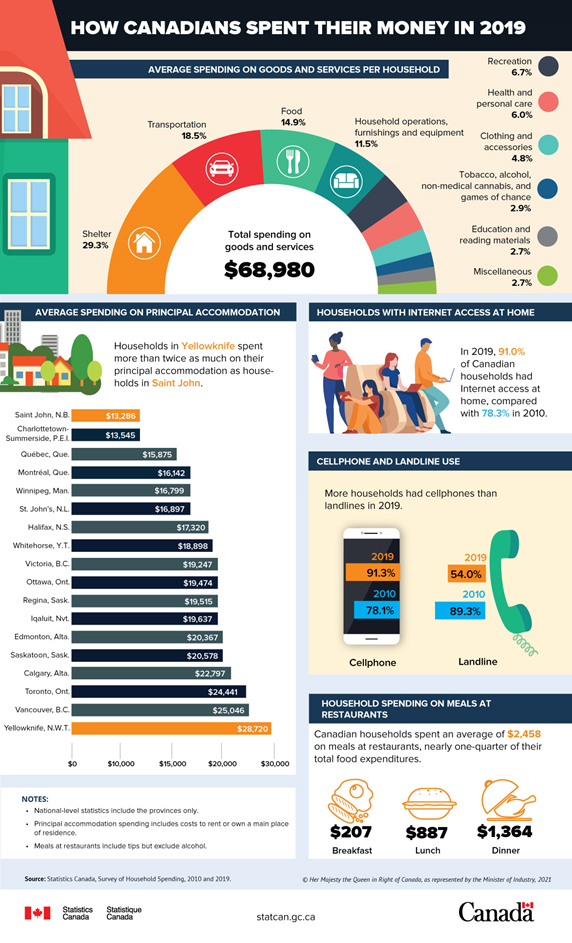

According to Stats Canada, in 2019, the average Canadian household spent $68,980. The average Canadian household earned $71,700 according to Workopolis.

Here is a snapshot of American consumer debt according to Bankrate:

Type of debt Average debt in 2020

Credit card $5,315

Personal loan $16,458

Auto loan $19,703

Student loan $38,792

HELOC $41,954

Mortgage $208,185

What should we do?

The title speaks for itself! Let’s face it — you probably already know what you need to do, but here are steps you can take:

- Figure out how much your debt is.

- Make a list of everything that you owe.

|

Liability Items |

Amount owing |

Monthly payment |

|

List outstanding bills individually (anything over 30 days — cell phone, utilities, rent, etc.) |

$xxx |

Minimum payment required |

|

List all credit cards and interest they charge individually (visa, MC, stores, gas, etc.)

Visa 20% MC 11% |

$10,000 $3,000 |

Minimum payment required |

|

Leases and their interest rate Car 3% Rent |

|

$300 per month $XXX |

|

List a loans with their interest percentage Mom and Dad 0% Student loan 5% Car loan 3% Mortgage 3% |

$1,000 $10,000 $150 $450,000 |

Minimum payment required

$800 per month |

|

Total |

$xxxx,xxx |

$xxxx |

- Figure out what you are spending your money on.

- Keep a copy of the receipt for every purchase you make for a month. If you have a spouse, keep track of all the receipts of the family spending. At the end of the month, tally these up per category (do this on a spreadsheet and save this for your budgeting process): mortgage/rent, food, gas, car insurance, house insurance, personal insurance, phone, cable, internet, clothing, liquor, banking, credit card fees/interest, charity, medical, pets, utilities, hair/nails, going out/restaurant/fast food/coffee/snacks, home repair, and savings/holiday account. Don’t cheat; you will only be hurting yourself — be complete.

- Tally it all up, compare it with your take home pay, and see where you stand. Are you in a position to save or do you have to tighten your belt for a bit?

- Then do the same exercise again for Month 2. Some months are more expensive than others. See how you do the second month? Did you learn anything from Month 1?

- For an excellent calculator, you can go to Debt.ca to use their Debt-to-Income Ratio Calculator.

- Pay cash for everything you buy. It makes you think twice about what you are buying.

- Research has found that when people use credit cards:

- People have less of a pain of paying syndrome — they spend more money.

- People often spend more money on unhealthy things, like candy bars, cookies, and junk food in general.

- People are more prone to spend ahead as opposed to saving up for it — the “I want it now” syndrome.

- Research has found that when you pay cash you:

- Experience less financial tension.

- Problem solve more and figure out how to do things less expensively.

- Stop micro-managing your finances.

- Shop more carefully and don’t overpay for items.

- Research has found that when people use credit cards:

- Create a monthly living budget and only buy what you need.

- When you are in the grocery store, keep a running total of what you are buying so that you don’t go over your budget.

- Do not get sucked into those impulse purchases that tempt you.

- Pay off your debts using the snowball method.

- Look at your debt (liability) list you created and use that as your base.

|

Debt |

Interest |

Minimum payment |

Owing |

|

Visa |

20% |

$ 300 |

$ 10,000 |

|

M/C |

11% |

$ 100 |

$ 3,000 |

|

Home Depot |

8.99% |

$ 100 |

$ 5,000 |

|

Line of Credit |

2% |

$ 100 |

$ 4,000 |

- Some gurus say pay the smallest amount; some say pay off the largest amount. I say pay off the highest interest first. No sense giving someone extra of your hard-earned money.

- Pay off the minimum that you can on all your liabilities, but pay as much as you can on the highest interest card, which in this case is the Visa card. Yes, it will seem a long time to pay it off but as mentioned before it is a marathon not a sprint. It does work.

- If you get the opportunity to transfer all or some of your debt from one card to another card with a lower rate, do it.

- You might try going to the bank and get an unsecured debt consolidation loan.

- Stay away from debt consolidation companies and bankruptcy if you possibly can.

- If you need to have credit cards, get the cards with the lowest interest rates possible. Getting cash back, travel points, and other bonuses are nice, but don’t you think you are actually paying for the “gift”?

- Start being an uber comparison shopper. You may only have to do this till you are out of debt, but you may find that once you start it becomes fun and you save a lot of money. The chore becomes a habit.

- Become a champion couponer. Why should you pay more when you can show a piece of paper or an image on your phone and pay less?

- Either eliminate going out to eat or having that extra double shot cappuccino.

- Plan your errands to include several stops a trip — dry cleaning, manicures, shopping (have a list), or haircut.

- Quit any memberships that you haven’t used in three months.

- Ask for a raise! My grandfather always told me that I always had a “NO,” but that doesn’t mean that I can’t get a “YES,” and he was right. I was often surprised how many times I received a “yes” when I didn’t expect it.

- Turn your passions into profits. Learn how to make money with what you love to do. Click here to get help.

Do what you need to do to get rid of that debt gremlin. You will be surprised how fast it will happen when you put your mind to it.